ev tax credit 2022 cap

For preapprovals processed through the date of this report 81863478 of the 100 million cap has been preapproved. The government caps the credit at 7500 maximum.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

From 2020 you wont be able to claim tax credits on a Tesla.

. Tax credit for hybrid and electric vehicles a milestone the automaker argues will raise its costs and hinder. But they still want us to throw 5000 or 7000 or 12000 credit to buy electric vehicles. Claiming the 7500 Electric Vehicle Tax Credit.

The companys plug-in RAV4 Prime small SUV with 42 miles. Toyota Will Lose the Full EV Tax Credit by the End of 2022. Tesla hit its EV tax credit cap in 2018 John WaltonPA Images via Getty Images.

Without incentivizing the actual userather than just the purchaseof electric vehicles current EV tax credits could actually drive higher carbon emissions. Still you would not receive a 2500 refund check from the IRS. Joe Manchin calls EV tax credits ludicrous in Senate hearing The coal millionaire says EVs are in short supply so they dont need subsidies.

17 hours agoSenator Joe Manchin who is a crucial vote in the evenly divided Senate raised concerns about the tax credit at a Senate hearing with Transportation Secretary Pete Buttigieg. Heres how you would qualify for the maximum credit. The credit applies to the year you buy the vehicle and your tax credit is capped at how.

As the article states the wealthy people who are. General Motors became the second manufacturer to hit this milestone in the final financial quarter of 2018. 2022 Calendar Year Federal Poverty Level Information.

Federal EV tax credits of 2500-7500 are available for new EVs and plug-in hybrids but not for hybrids. 1 day agoThe best EV tax credits in 2022 offer consumers up to 7500 in creditsand that number may go up to a whopping 12500. The new credits if Biden and Democrats finalize a deal would jump to 12500 maximum.

QUALIFIED EDUCATION EXPENSE TAX CREDIT January 31 2022 The Qualified Education Expense Credit Cap is 100 million 2022 Year. Toyotas sales chief for North American Bob Carter said Wednesday April 6 2022 that the automaker expects to reach a 200000-vehicle cap on the credits before the end of June. Ago TaycanTurbo ETronSportback MX gone No tax filing in this year is for the 2021 tax year so only vehicles purchased in 2021 would apply.

All-electric and plug-in hybrid cars purchased new in or after. Current EV tax credits top out at 7500. The credit must be used in its entirety in the year of purchase.

But the Kia Niro EV is eligible for the full 7500 tax credit because of its larger battery size. As such there is 18136522 remaining in the cap. 2 days agoMay 2 2022 700 AM PDT.

20 hours agoCar News. For example if you owed 5000 in federal taxes and received a 7500 federal tax credit for buying an electric car your taxes would be reduced to 0. Then from October 2019 to March 2020 the credit drops to 1875.

Biden also backed a 30 credit for commercial electric vehicles and a 4000 used EV tax credit and making the current credit refundable at. Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. A federal tax credit of up to 7500 is available for new EVs and some.

Senate passes measure for 40000 cap on the EV tax credit and only EVs priced under 40000 would be eligible for 7500 credit under this plan. Is inching closer to using up a key US. Perhaps the cap is 50000 in essence 40000 for the average vehicle cost plus 10000 for the EV price differential which the tax credit then neutralizes with the maximum credit amount of from 7500 to 12500.

1 hour agoPreviously President Joe Biden proposed increasing the current EV tax credit from 7500 to as much as 12500 for union-built electric vehicles while also introducing a 4000 credit for used EVs and making companies like Tesla and General Motors which have already surpassed the current 200000 EVs sold cap for the existing tax credit. Toyota reached the cap largely by selling plug-in gas-electric hybrid vehicles. Kea Wilson reports on a new study that calls out US.

To qualify automakers must build the EV in the US with union labor for an extra 4500 over the current. 2 Must be used in 2022. From April 2019 qualifying vehicles are only worth 3750 in tax credits.

If you purchase the vehicle in 2022 then you can only claim the tax credit under the then-applicable rules on your 2022 tax return next spring. The second aspect is the political optics. Theres a waiting list for EVs right now with the fuel price at 4.

Electric vehicle incentives for contributing to higher carbon emissions. Even for EVs with giant batteries they arent. Federal Tax Credit Up To 7500.

The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles.

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

.jpg)

Latest On Tesla Ev Tax Credit March 2022

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

How Electric Vehicle Tax Credits Work

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Solar Incentives In Utah Utah Energy Hub

Nissan Ariya And Leaf Will Coexist Two Evs Well Under 40 000 Thanks To Ev Tax Credit

Latest On Tesla Ev Tax Credit March 2022

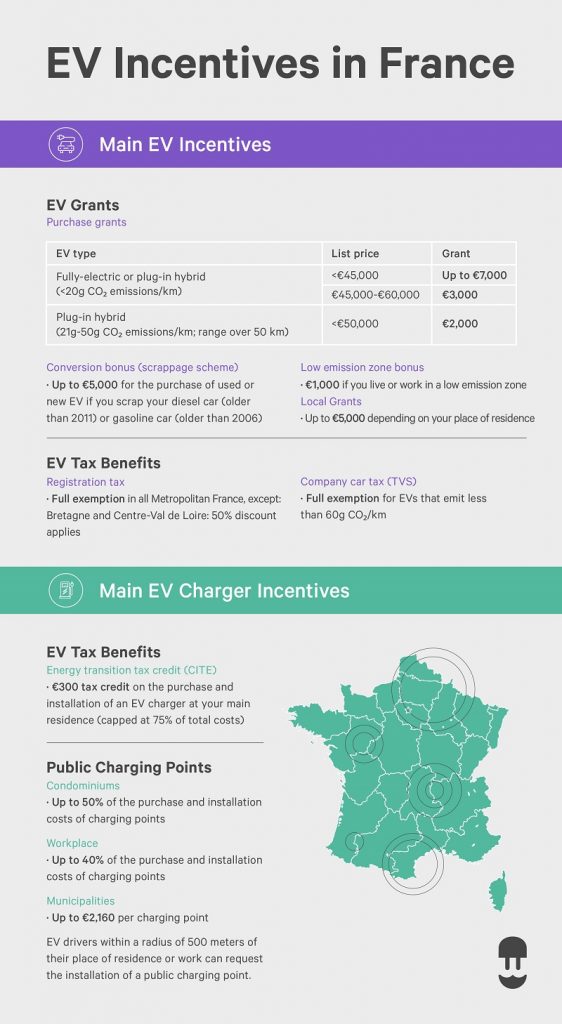

Ev Incentives In France Complete Guide Wallbox

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

How To Calculate The Federal Tax Credit For Electric Cars Greencars

How To Calculate The Federal Tax Credit For Electric Cars Greencars

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Ev Tax Credit Calculator Forbes Wheels

Toyota S Ev Tax Credit Cap Is Expected To Be Reached Soon Bloomberg

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa